2025 Apartment Housing Outlook

By Paula Munger |

It was not all about the supply in 2024, despite headlines dominating to the contrary. Apartment market demand held up well, occupancy rates increased, and rental rates began to moderate at the national level.

But because real estate is local, it is important to delve into the pain points of many metro areas across the country. Markets such as Austin, Texas, Raleigh, N.C., San Antonio, Denver and Phoenix are still experiencing declines in effective rents, along the order of 2.5% to 5.5% year-over-year, according to CoStar. All of these markets had high levels of construction with some, like Austin, delivering new units measuring more than 10% of its current stock in just 12 months. The national average is 3.6%. Effective rents in Austin have decreased by nearly 10% while occupancy rates have plummeted by 9 percentage points since recent peaks.

Many of these same markets are also experiencing exceptional levels of demand, however, with year-to-date absorption coming in only second to the record-breaking 2021. Despite a cooling labor market, there was significant job growth in 2024, as 1.7 million jobs were added to U.S. payrolls through October. Alongside wage growth that is persistently elevated, renters were confident enough in their financial situations to move into a new apartment. Combined with discounted rents and concessions in certain markets, some were even able to upgrade their current living situations for a marginal rise in cost.

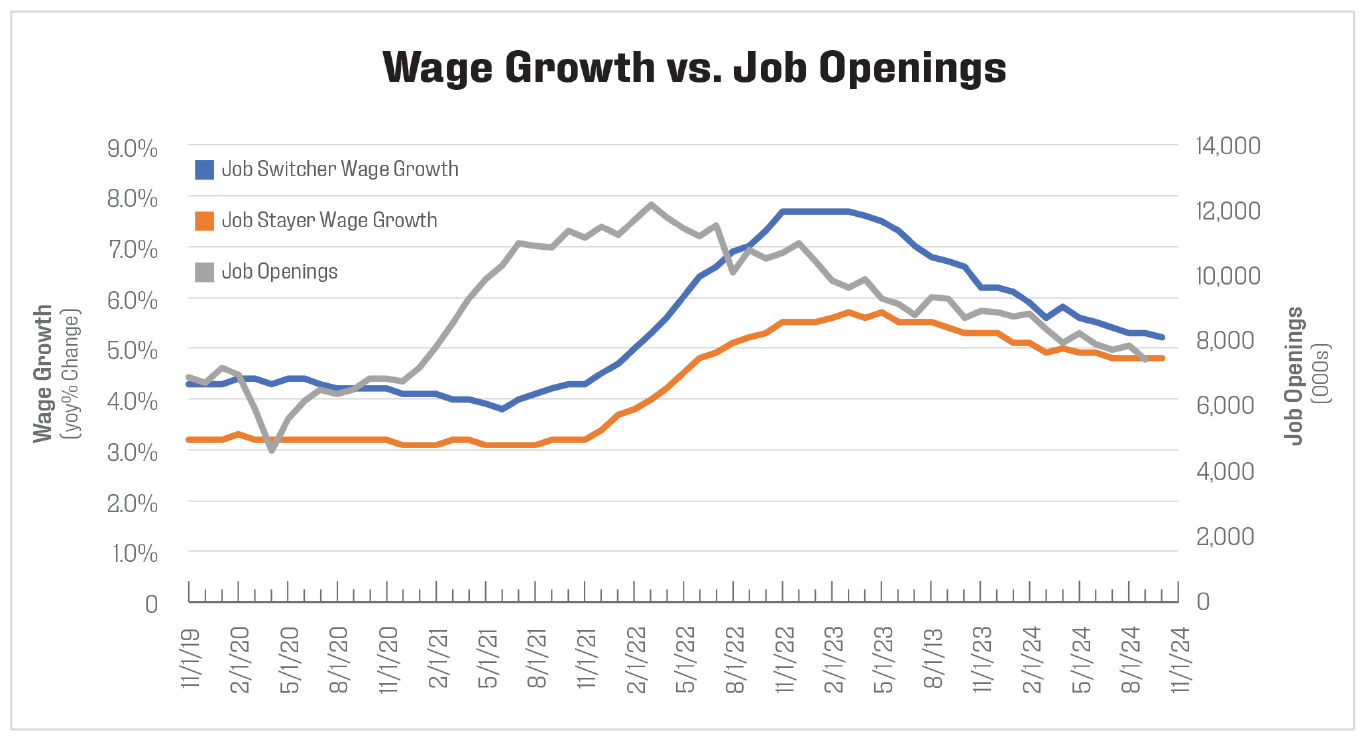

The waning yet strong labor market is depicted in several data series in the chart below. There were 4.7 million fewer job openings in September 2024 than at the all-time peak in March 2022, equating to just 1.1 jobs per unemployed person. In 2022, employees took advantage of job availabilities to switch jobs and earn more money. Although off from the heady peaks of that year, wages for both job stayers and job switchers remain elevated from pre-2020 levels. The quits level—not shown in the chart—mirrors the trend in job openings and provides one more signal of a weaker labor market. Just 3.1 million employees quit their jobs in September, a level not seen in more than six years. During the “Great Resignation” some 4.3 million to 4.5 million employees were quitting their jobs every month for better, and often higher-paying, opportunities. The tides have turned more toward an employers’ market, meaning wage growth should begin to moderate further in 2025.

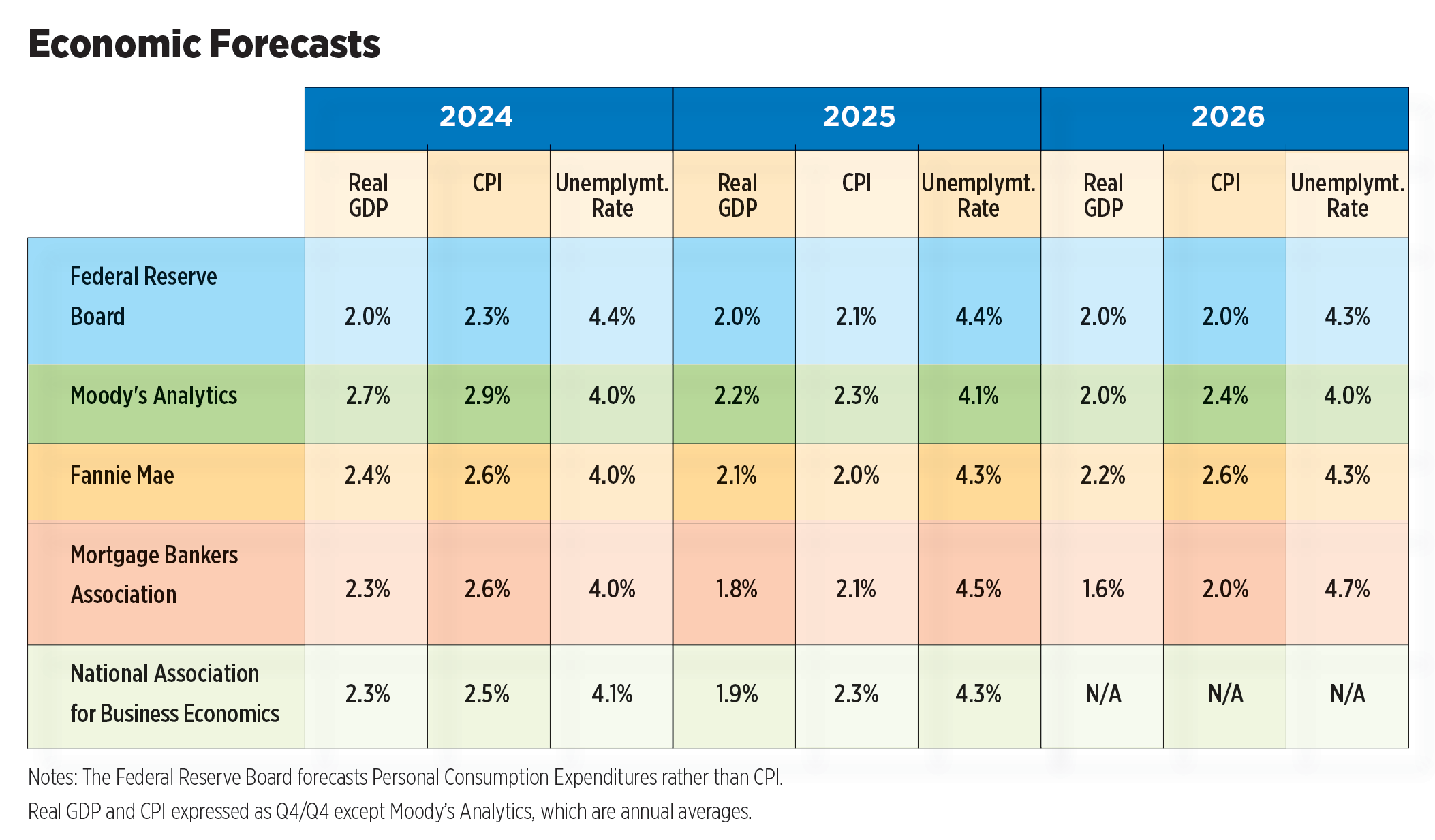

The unemployment rate was yet another sign of a softening labor market. Its increase of 60 basis points from January to July triggered what is known as the “Sahm Rule,” an indicator that a recession has begun. But the upturn was short-lived, and the unemployment rate settled back down to 4.1% by October, a historically low level. Forecasts are broadly in line in terms of unemployment inching up in 2025, but at 4.5% and lower, they remain well within what is considered full employment. 2026 forecasts range from 4.0% to 4.7%. Layoffs are low by long-term norms, and while more Baby Boomers are expected to leave the labor force in the coming years, there’s every indication to suggest employment will hold up well through the forecast period. Downside risks to the job market may come by way of stringent immigration policies from the incoming administration.

Real gross domestic product (GDP) surprised to the upside thanks to consumers, who continued to spend on goods and services throughout the year as wage growth outpaced inflation. GDP forecasts are mixed with several expecting it to meet or exceed its long-run potential of 2.0% in 2025 while others predict a pull-back next year. It’s important to note that some of the forecasts included in this outlook were published prior to the November presidential election results and the subsequent rise in consumer confidence.

Inflation mostly receded throughout 2024, although items like shelter and other services remained sticky. In October, headline inflation was up 2.6% year-over-year. The 2.4% increase in September was the lowest since February 2021. Inflation is expected to stay under 3.0% in both 2025 and 2026. Tariffs proposed by the Trump Administration will absolutely have inflationary impacts, but the magnitude, timing and legalities are big unknowns. Even if tariffs are implemented as outlined, the effects are expected to be temporary, relatively minor and not a repeat of the recent high inflationary period.

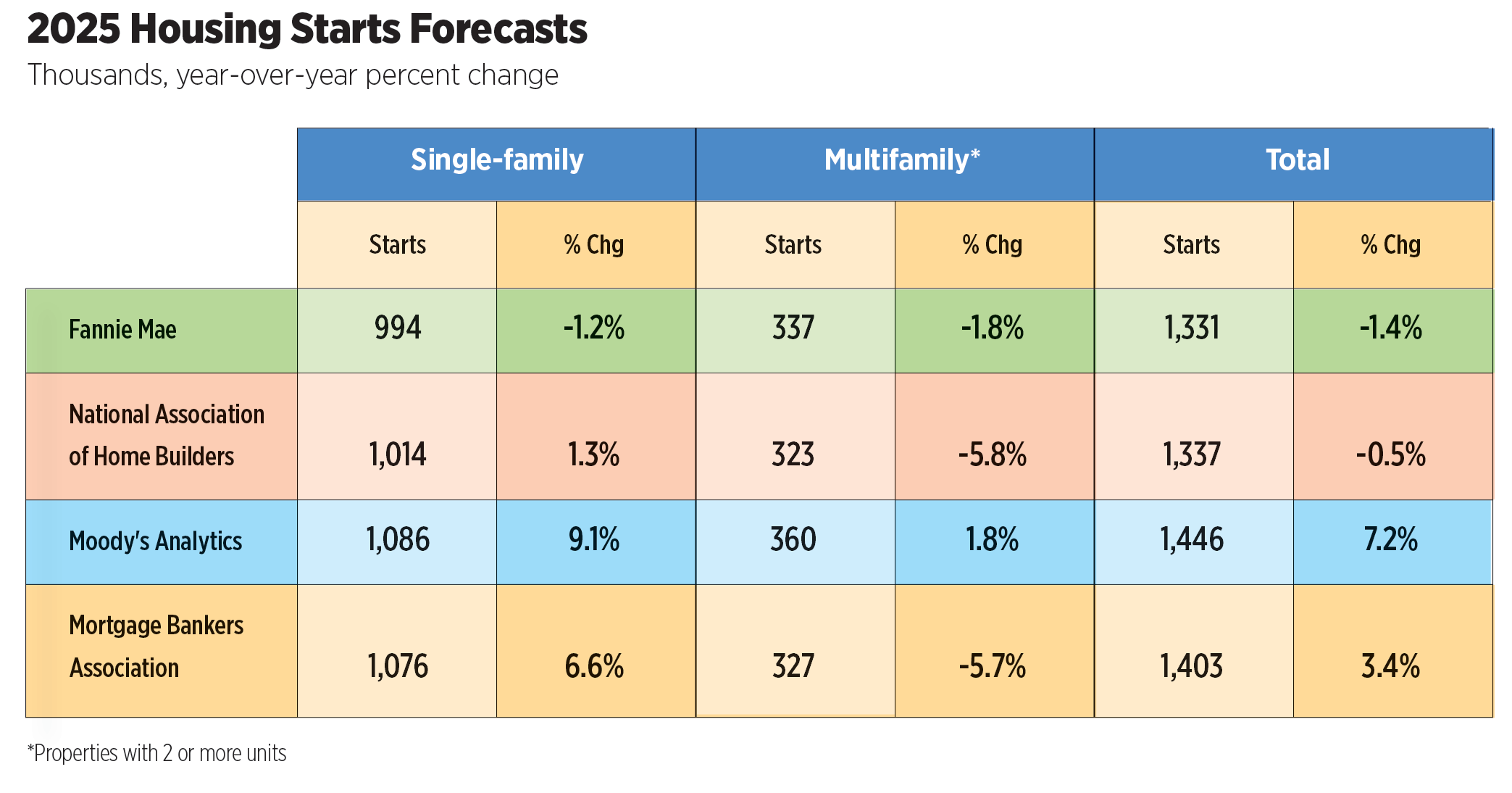

Construction deliveries for apartment properties linger at 50-year highs, while those in the for-sale market are as strong as they’ve been since before the Great Recession. Permitting activity and starts have widely diverged in 2024, however. Year-to-date through October, single-family permits and starts were up 8% and 10%, respectively, compared to the same period last year while multifamily permits fell 23% and starts were down 29%. With mortgage rates moderating somewhat and homebuilders continuing to offer incentives, the demand for new homes is fairly healthy. And while demand for apartments is also strong, it is only now starting to catch up to new supply and by no means across every market. In addition to waiting for some of the excess supply to be absorbed, developers are dealing with high interest rates, high costs and difficulty obtaining construction financing.

The forecasts for housing starts are mostly consistent in the majority calling for single-family starts to rise and multifamily starts to decline in 2025. The NAA/John Burns Research & Consulting (JBREC) Apartment Developer and Investor Survey for Q3 2024 revealed that 65% of developers expect starts will decrease in the next 12 months, up from 41% in Q2. Only 15% expect them to accelerate.

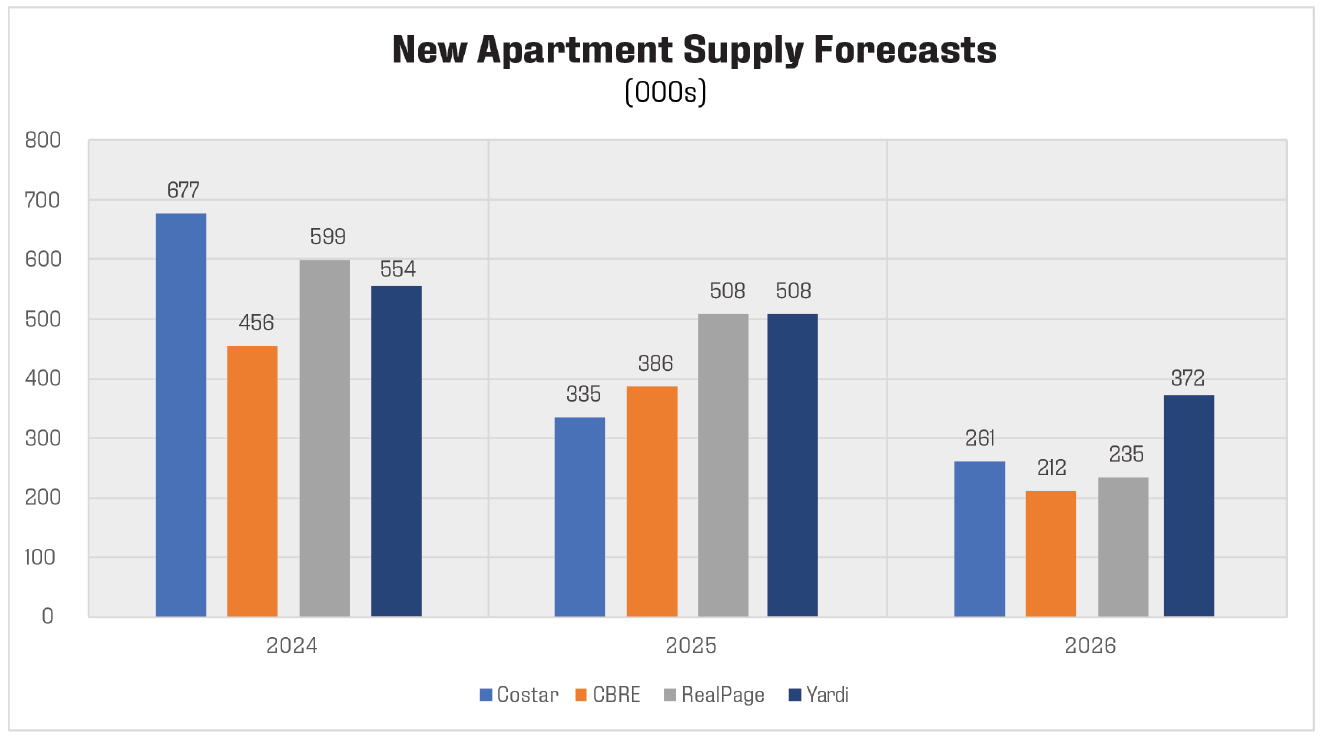

Private sector data providers are projecting apartment completions to drop next year by as little as 8% to as high as 51%, with another plunge in 2026. The estimated cumulative reduction in 2025 and 2026 ranges from 33% to 62%. While fewer deliveries next year will be a welcome respite in several markets, the extraordinarily low number of deliveries in 2026 could spell trouble in terms of rental housing shortages and attendant rent increases, thereby erasing gains made in affordability in some of the highest-supplied markets. The numbers projected in 2026 would be the lowest since 2013-2014.

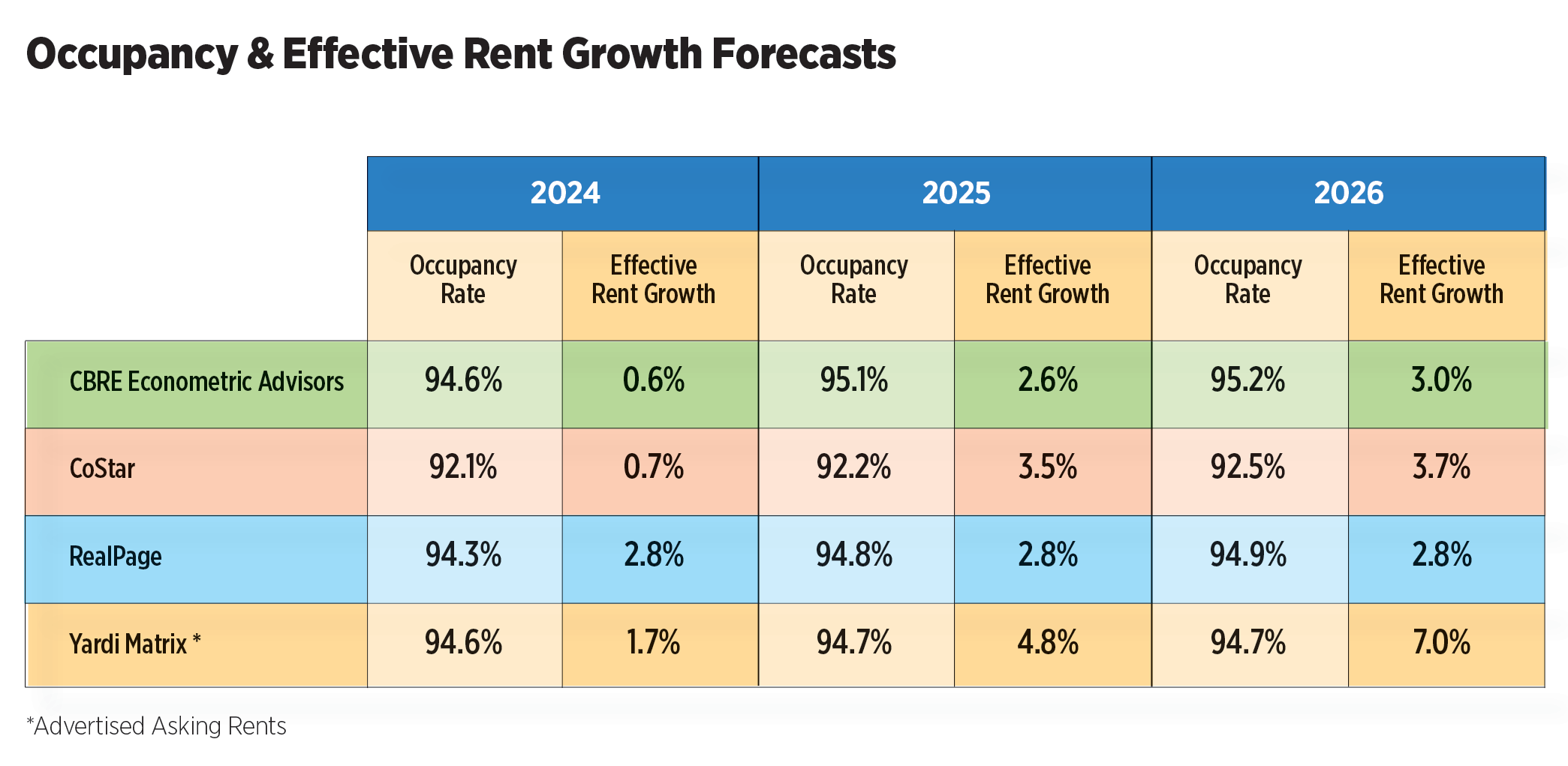

Forecasts for apartment market indicators show steadily improving occupancy rates, increasing by 10 to 50 basis points in 2025 and up to 30 basis points in 2026. Effective rent growth is expected to be considerably stronger in 2025 than this year, ranging from 2.6% to 4.8% and returning to more historic norms in 2026 in the 3.0% to 4.0% range. The potential for upside risks for both occupancy and rents is high, given the sharp contraction in new deliveries in 2026. In fact, Yardi Matrix is forecasting 7% rent growth in 2026, due to fewer deliveries and robust demand over the next 12 to 24 months.

High interest rates remain a drag on profitability and recent comments from Fed officials suggest they are in no hurry to cut further, while the yield on the 10-year Treasury has also been on the upswing. However, the transaction market appears to have turned a corner with volumes beginning to pick up. The Q3 2024 NAA/JBREC survey showed that investors have easier access to both debt and equity financing for acquisitions compared to six months ago, and more than one-third expect to purchase apartment communities over the next six months.

The swiftness of the presidential election results did wonders for financial markets as well as business and consumer sentiment, although uncertainties around policies continue. Mass deportations and/or stricter immigration policies could have harmful effects on both the labor and rental housing markets. The construction industry, in particular, stands to suffer as foreign-born workers comprise 29% of the sector, according to the Census Bureau. And while the regulatory environment at the national level will ease, adverse housing policies at the state and local levels are not going away, nor is extensive litigation. But the industry will have a lot going for it in 2025: A unified, business-friendly federal government; absorption of excess supply, resulting in improved rent growth; and steady demand on the back of what is arguably the healthiest economy in the world.

Paula Munger is Vice President of Research at NAA.